The rise of Qualcomm alternatives. Time to take them seriously?

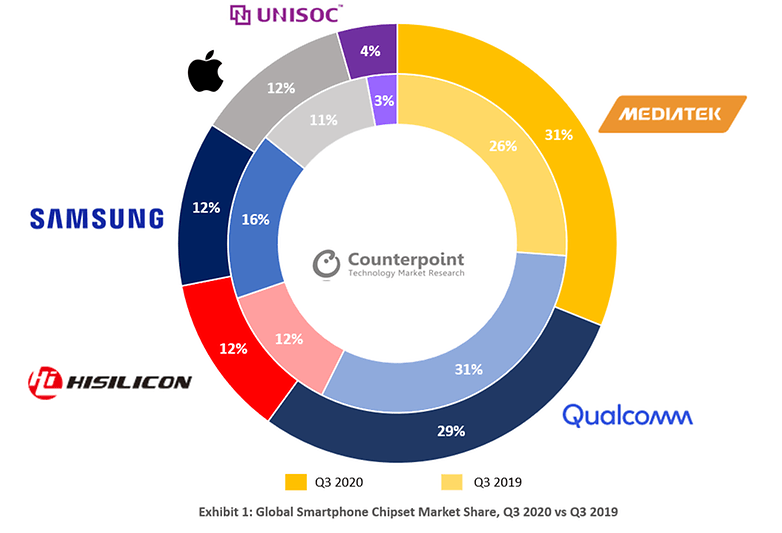

In December 2020, tech blogs around the world reported something very interesting. Taiwanese chipmaker MediaTek, for the first time since its incorporation, shipped more chips in Q3, 2020, than Qualcomm. The news did come as a surprise to many seasoned tech reporters because for a very long time, Qualcomm was thought to be the infallible, unchallenged market leader. What changed?

And it’s not just MediaTek. Samsung’s Exynos lineup of processors which were widely reported to be ‘inferior’ to their Qualcomm counterparts suddenly started looking a lot better. The performance gap between Qualcomm chips and competing products from its competitors are at an all-time low. Was this a case of Qualcomm slowing down or the competition simply catching up?

Challenging a near-monopoly

From the outside, competition in the mobile chipset space looks quite healthy. The industry primarily has five players; Qualcomm, Samsung (Exynos), Huawei (Kirin), MediaTek and Apple. Upon closer inspection, you will see that Samsung (until recently) wasn’t too aggressive with its mobile chipsets. Huawei faced its own set of challenges as a Chinese firm and is currently embroiled in a mess from which it is unlikely to recover unscathed. Apple is one company that can challenge Qualcomm in terms of technology - but it makes its own devices and does not directly compete against Qualcomm except, perhaps in the flagship segment. This effectively leaves one competitor that could possibly pose a challenge to Qualcomm in the long run: MediaTek. Unbeknown to most, at least in the west, the Taiwanese company seems to be already doing a good job at that.

For many of us, MediaTek continues to be an irrelevant competitor that is too small to be taken seriously. The two companies, at least until a few years ago, seemed to be targeting completely different target audiences. While Qualcomm was known for its uber fast, high-end performance-oriented chips that boast of the latest and greatest features, packed with cutting edge technology and sold in high-income, developed countries, MediaTek powered phones were mostly considered only good enough for lower-tier phones that typically sell well in low-income countries.

Of late, however, this status quo seems to be changing.

The power of emerging markets

Even though there is still some stigma over the MediaTek brand name in the west, the company has been largely able to get rid of this tag in developing markets. MediaTek has been particularly aggressive in China and India, which with a combined population of more than 2.8 billion people constitute nearly 40% of humanity. The company understood these markets better than Qualcomm way before the smartphone sector there peaked. And the strategy seems to have paid off as reflected in the market share figures of Q3, 2020.

Apart from increasing its brand recognition, MediaTek has gone on to become a respected player in the segment. More importantly, the company has been able to drive down the cost of smartphones in these price-conscious markets – much to the delight of consumers. This is in complete contrast to Qualcomm’s policy – especially in the west where its monopolistic tactics often led to price increases.

The latest such example is as recent as 2020 when Qualcomm decided against adding an integrated modem on its flagship Snapdragon 865 chip. Instead, they forced companies to pay extra for the 4G/5G compatible X55 modem at a time when 5G wasn’t really as widespread. The result? Consumers had to shell out more money to buy Snapdragon-powered flagship smartphones last year. Smartphone brands simply passed on the needless extra burden to the consumer. What was even more surprising was that Qualcomm’s cheaper 7-series processor - the Qualcomm Snapdragon 765G came free of all these problems and had an integrated 4G/5G capable modem.

This is in complete contrast to their behaviour in emerging markets where the challenge posed by MediaTek has led them to reduce the prices of their SoCs. MediaTek’s Helio series of processors have gone on to become capable alternatives to Qualcomm’s 4 series and 6 series processors. MediaTek seems to have no plans of stopping at this, though. Quite likely, they have set the ball rolling for a similar onslaught in the high-end segment.

Hitting where it hurts the most

For Android smartphone buyers in the West, Android smartphones that feature Qualcomm SoCs have always been the norm. The company dominated the smartphones segment ever since the birth of Android in 2008. Over the years, the San Diego based fabless chipmaker has been able to create a virtual monopoly in the segment and steamrolled most of the competition - including the mighty Samsung.

There is no doubt that Qualcomm, to this day, dominates the high-end smartphone SoC segment – both, in terms of market share and actual performance. However, most of its competitors are stepping up the game. MediaTek debuted its Dimensity range of chips in 2019 with a single-minded focus to dethrone Snapdragon’s 8 series chips. While they have still not managed to usurp the performance crown from Qualcomm, they are getting closer to that goal with each successive release.

Samsung too seems to have woken up from its slumber, and its new Exynos 2100 is closer to the Snapdragon 888 in terms of performance than an Exynos has ever been in recent times. MediaTek seems to be also upping the game in terms of radio and network support. The company was in the news recently after it debuted its first mmWave compatible modem - at the time the fastest in the world. If both these chipmakers continue the trend, it is quite likely that by 2022-23, we might be looking at either of them finally beating Qualcomm. That is unless Qualcomm pulls of a virtual rabbit out of their hat and come up with something truly incredible.

What challenges Qualcomm, however, is not just the threat of losing the performance crown to others but the chances that it MediaTek’s arrival into the high-end chipsets space will drive down prices of high-end smartphones. Qualcomm is also looking at the prospect of losing some of its lucrative clients if MediaTek chipsets begin to offer equivalent performance at much lower prices. With Indian and Chinese smartphone markets continuing to grow, there is also the likelihood of the centre of power moving from the west to Asia where rising income levels and a large population will create a surge in demand for high-end phones. And with both MediaTek and Samsung doing better than ever before in this segment, there is no doubt that Qualcomm has its task cut out.

Challenges ahead

It’s not all hunky-dory for our Qualcomm alternatives, though. While Samsung’s improvements with their new Exynos chipset is promising, they are still leagues behind Qualcomm in several areas - particularly thermals, and graphics performance. While the latter can be potentially solved when Samsung switches to AMD’s RDNA architecture GPU in the next generation, it remains to be seen how well the next Gen Exynos chips solve issues with power efficiency. Moreover, we are also not entirely clear about Samsung’s path for Exynos since their usage outside of Samsung’s own smartphone models is limited.

For MediaTek, the biggest challenge at hand seems to not only consistently deliver products that match the performance of competing Qualcomm products but to also shed its tag of being a ‘low priced alternative’ to the former. This is going to be a difficult task for them and is likely to be more difficult to achieve in developed markets.

Do you think the likes of MediaTek and Samsung have what it takes to challenge Qualcomm’s dominance in the smartphones semiconductor space? Will you ever consider a flagship smartphone made by MediaTek when there is enough data to prove that they are as good as their Qualcomm competitors? Do let us know in the comments below!