My honest experience using the mobile bank, Revolut

Read in other languages:

"We don't take cards, sorry, we're in Berlin." How many times have I heard this sentence since I arrived in the German capital! "Nein, nein..." For those who know this city, the question of cash payment inevitably arises for newcomers or tourists from countries where credit card purchases are made daily, even for small amounts. This is where the use of payment apps becomes a question of survival. I'll tell you about my experience with Revolut.

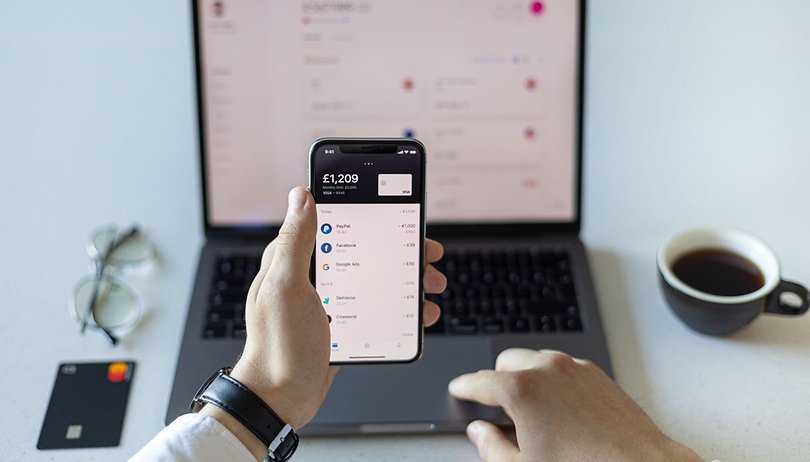

A functional app integrated into your daily life

Since the advent of online banking in the 2000s, payment methods and bank account management have changed radically. Online payments, bank transfers, SMS alerts, the use of TAN or Touch ID Login have become part of the daily lives of millions of people. And yet, a city home to plenty of tech startups still resists the invader... Berlin still has many bars, cafés, and restaurants where you can only pay in cash. Faced with this situation, there is a solution that I had long underestimated: Revolut.

The Revolut app is a great way to withdraw money without bank charges and pay with your smartphone. This is an offer that does not apply any fees or expensive exchange rates (ideal for holidays outside the EU). With Revolut, you can create an account very easily online and you get two means of payment: a bank card (free of charge) to make "normal" payments and an app that you can use to pay in stores by placing your phone on the barcode reader.

The little extra that I personally use is to send myself money in one click at no cost from my "official" bank account. I can either withdraw money free of charge from an ATM (a very complicated thing in Berlin, for example), or pay for any purchase with my phone without having to waste time typing a code (practical in a city where people get agitated as soon as someone takes too much time at the supermarket checkout).

App information:

- Last updated: January 28, 2020

- Size: 50MB

- Current version: 6.24

- Compatibility: 5.0 or higher

- Content classification: All audiences

Top class security

The issue of security of online payments is one of the major concerns of consumers. Add to that the fear of losing or having one's credit card stolen. If we add up these two anxieties and think about Revolut, we have potentially enough to worry about. The app gathers both a quick option of payment by phone via a secret code and a credit card whose expenses can be tracked directly on the app. The amount is displayed on the screen and you can manage your budget.

Revolut responds to your anxieties by offering the possibility of activating or deactivating contactless payment and online payments with a single click. But most importantly, the app allows you to block or unblock your credit card in a few seconds. In addition, you are notified with each payment and the balance is displayed on your screen. No more anguish to oppose after a credit card theft. By the way, some banks ask for additional information to cancel the card that you obviously don't have if you are in a panic or have been the victim of a pickpocketing robbery!

Now, I don't know what would happen if I got my phone stolen. Revolut's user reviews are full of testimonials about problems encountered when reinstalling the app. Some people also report difficulties in reinstalling Revolut.

As customers of different banks, we all agree that bank charges are very expensive. Some even feel that people are being extorted for banking services such as texting, agency fees or other types of services. Revolut offers a free service, but limited to five domains:

- Free UK account

- Free IBAN Euro account

- Interbank exchange rates in more than 150 currencies

- Exchanges in 30 fiduciary currencies up to €6,000 per month with no hidden charges

- No ATM withdrawal fees up to €200 per month

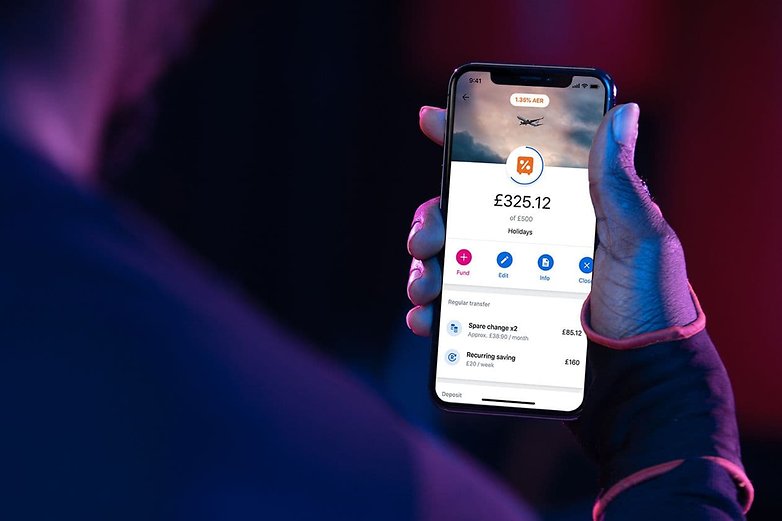

Revolut offers a Premium option for €7.99 per month which includes medical insurance abroad, luggage insurance, a premium card with an exclusive design and higher ceilings for all banking transactions. Personally, I think this offer is more for people who travel a lot for business reasons. This is especially the case for the monthly offer at €13.99 which is really a business offer with access to airport lounges and a "concierge service adapted to your lifestyle". I am still convinced that the app in its free version is more than enough, because its appeal lies in its gratuity.

I was very skeptical before I went on that trip to Latin America. I usually take cash and pray I don't get robbed on the spot. So far, I've just had my credit card stolen once in Peru and the cancellation of my card turned into a real nightmare (they kept using my Visa card despite my opposition...). So I took my Revolut card and my phone with the idea that it might not work.

In the end, it was a real success and a real relief. I was able to pay in the supermarkets with my phone and the exchange rate was frankly a bargain compared to the official (bank) and unofficial (in the street with the 'cambistas') exchange rates. Above all, I was able to withdraw small amounts of money on the spot without charge, which was ideal for security purposes. I could now better enjoy my trip and feel comfortable.

I don't know if I can say that Revolut has changed my payment habits, I still have a main account and I don't know if the app could really work as an "official" bank account. I just know that I have gained a lot of peace and quiet and I can now go out better in the city where I live without worrying about bank withdrawal fees. Not least of all. I think Revolut works very well as a complementary app to your main account because it really saves you time. In addition, you can send small amounts of money free of charge to your family or friends. The app also helps to solve problems when sharing a bill at the restaurant.

And you, do you use payment apps? What do you think about options like Revolut? Why do you think we still can't do without traditional banks? Leave us your comments.

My fight right now is to keep innocent people from becoming victims like us, reporting any trader, or platform is a step ahead of the fraud and the fraudsters so please if you have had any issues in the past or present, or you notice somethings unusual with your broker, trader etc, No specifications, it could be Binary option, crypto currency, forex, stocks and so on. report to IVT cysec on Dimitru at ivtcysec-recovery,tech

Doing so will help you with a close follow up and could lead to you getting your money back if lost but most important it will help other innocent people stay safe and avoid this fraud....

I was of you opinion, but then things hit home after years using Revolut read more about it at reddit reddit.com/r/Revolut/comments/g2byao/revolut_bug_stole_my_money_revolut_refuses_to/

I use the Revolut card for daily shopping and I am very pleased because it gives me the opportunity to see what I bought more often, to be able to attach a photo of the voucher. So far only the standard version, but I would like to upgrade to Premium.

-

Admin

Jan 31, 2020 Link to commentAfter reading it, sincerely it sounds like a long (maybe paid) advertising for a bank. Anyway, if it is all free, how do they make their money? And merchants, if they want to accept these payments and do not accept credit cards, need to have a reader? Complicated and not practical, at least in Asia.

We would make it clear if it was a paid advertorial. This one is not.